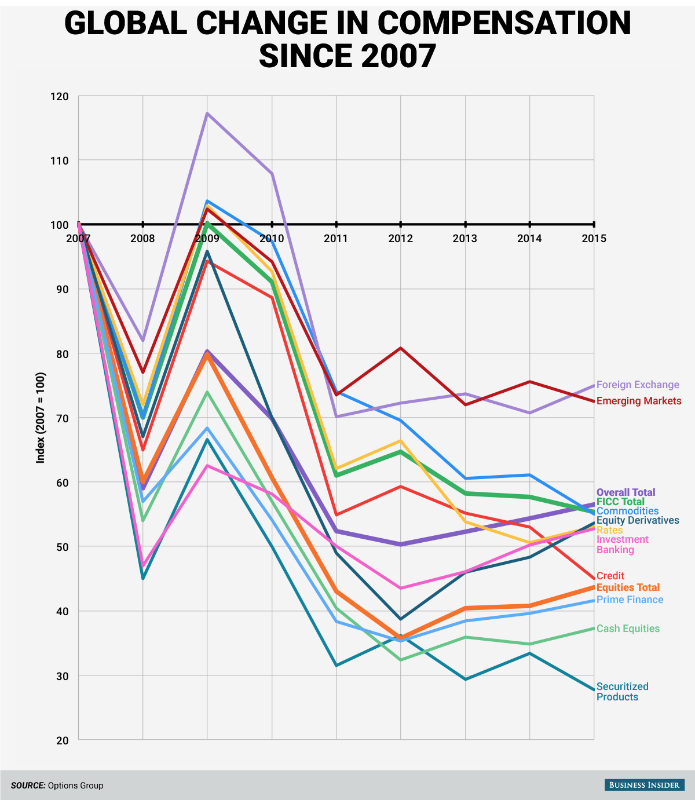

The following chart shows how overall compensation of the top performers (25%) in investment banking has fallen in the past 7 years. There is a significant downward trend-a loss of 30%-70% of overall compensation depending on specific sub-industry.

Obviously some correction was to be expected after the bubble burst of 2009, but it looks like compensation kept going down in the last few years as well.

Salaries in high-tech on the other hand have risen sharply. I am saying this based on my own personal experience interviewing and getting offers as well as recruiting and making offers as a hiring manager. It is also not hard to get actual data backing this, for example, this Fast Company article showing that the 3 highest paid positions with better than normal pay raises are in engineering or science.

It is pretty obvious (in my opinion) that high tech is the top destination for software engineers. You get a feeling that you contribute to an actual product and can change the world for the better, as well as be at a company where engineers are first class citizens and leaders rather than service providers.

But adding these two observations (falling compensation in banking and rising compensation in high tech) leads to high tech being a preferred destination also for business people like MBA graduates. I recently read a 2014 Economist article showing how graduates of top MBA schools are migrating away from finance and investment to technology.

This is a good trend for high tech and a bad trend for banks. It is also a good trend for Silicon Valley and Seattle (that have large high tech industry) and a bad trend for the New York area. Finally, I think this is a good trend for society as building (actual) products become a more rewarding career choice.